*Note: 2018 property tax bills will be mailed out in August

Property tax due date

Property tax due date

Property taxes are due on October 31.

Paying property taxes

In person at the RM office:

- Office hours are Monday to Friday from 8:30 am to 4:30 pm

- The RM office is located at 1043 Kittson Road in East Selkirk.

- For after-hours payments, use the mail slot at the back door (top of the stairs) of the RM Office

Payment methods

- Cheque (payable to the RM of St. Clements, can be post-dated)

- Cash

- Debit: Check with your financial institution to ensure your point of purchase limit is high enough for the amount you wish to pay

Please note: we currently do not accept credit card payments

By Mail

Send cheque payable to the RM of St. Clements (may be post-dated):

Box 2, Group 35, RR 1

East Selkirk, Manitoba

R0E 0M0

Pre-authorized payments (PAP)

- PAPs are regular payments drawn monthly, quarterly or annually from your financial institution and can be set up at the RM office

- You will receive a tax statement in the summer

- Payments made before July 31 will not be reflected on your tax statement but have been credited to your tax account

- Review regularly to ensure proper payments are being made as you are still responsible if your financial institution makes an error

Online

- Pay online through your financial institution’s website

- For this service we have partnered with BMO, TD Canada Trust, CIBC, Manitoba Credit Unions, RBC, Scotia Bank Group

- Login to your financial institution’s website to make the payment

- Set the transaction up as a bill payment. For the bill payee, it varies between financial institutions but it will be something like ‘RM of St. Clements (taxes)’

- Use your roll number as the account number

- Drop any zeros at the start of the number, ignore the decimal, and add any numbers after the decimal

example 1: roll number 00012345.123 would be account number 12345123

example 2: roll number 00054321.000 would be account number 54321000

- Drop any zeros at the start of the number, ignore the decimal, and add any numbers after the decimal

- Make the payment as you would a bill payment

- Contact your financial institution if you are not sure how to set this up

- For this service we have partnered with BMO, TD Canada Trust, CIBC, Manitoba Credit Unions, RBC, Scotia Bank Group

Late payments

Penalties of 1.25% will be added on the first day of every month that taxes are in arrears*. Properties that are in arrears two years as of January 1 of the current year are subject to tax sale proceedings.

* arrears: money that is owed that should have been paid earlier

Property tax statements

- Tax statements are mailed out mid-summer of every year

- Tax statements are sent to the address the RM has on file

- If you didn’t receive a tax statement, you are still responsible for paying your property taxes

- Contact the RM office at 204-482-3300 to request a copy

- It is the property owner’s responsibility to ensure that the RM of St. Clements has the correct mailing address

- If you are on the Pre-authorized Payment (PAP) plan, you will still receive a tax statement

- The balance will show payment to July 31 of the previous year but your account has been credited

Tax Statement appeals

You can not appeal your statement, but you can appeal the assessed value of your property through the board of revision held every fall.

Moving in or out of the municipality

Let the RM office know of any change in ownership or mailing address in order to ensure that the tax statement is properly forwarded.

If the property is in the process of changing owners, the person named on the tax statement is responsible for paying the property tax.

If ownership changed after the tax statement was issued, please forward the tax statement to the current owner or return it immediately to the RM office.

The property owner is responsible for tax payment even if they didn’t receive a statement and are liable for penalties arising from late payment.

Education Property Tax Credit (EPTCA)

The EPTCA Application form is available on the Department of Finance website (https://www.gov.mb.ca/finance/tao/eptc.html ) or at the Municipal office. This website also has a list of Frequently Asked Questions about EPTCA.

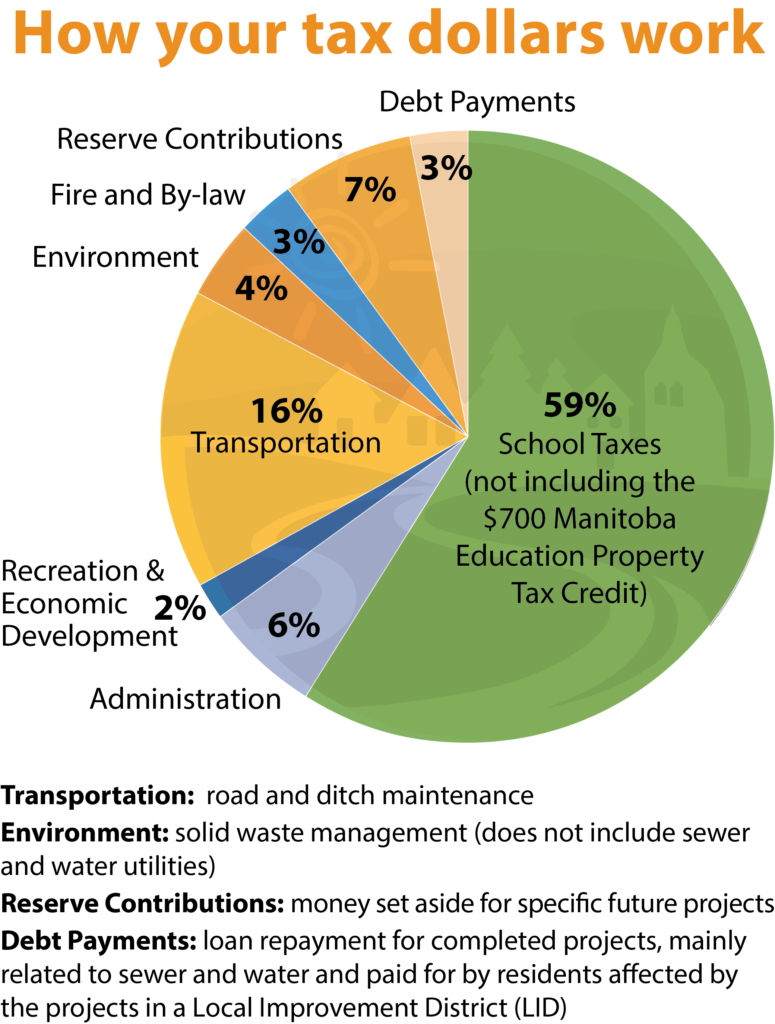

Whether you own or rent your home, you could be eligible to save up to $700 with the Manitoba government’s Education Property Tax Credit (EPTC). The credit is provided by the province of Manitoba to help cover the school taxes you pay, or a portion of your rent either directly on your municipal property tax statement or through your income tax return.

Seniors may be eligible for additional savings. See below to learn more.

Home owners

If you own your home and pay property taxes, you can save up to $700 off your property taxes with the EPTC. To check if you are already receiving the Credit, review your property tax statement from your local municipality to see if you receive the “Manitoba Education Property Tax Credit Advance”. If you do not already have the Credit applied to your municipal property tax statement, you can still receive it:

- The credit can be applied to your municipal property tax statement if you apply before November 15. To qualify for this option, you must have lived in your home since January 1 of the current year. Using this approach, the credit will be applied to your property taxes and you will only then be required to pay the difference. In the following year, the credit will automatically be advanced on your municipal property tax statement.

- After November 15, you can claim the EPTC on your personal income tax return. The Credit is claimed on the Manitoba Income Tax Form MB479 – Manitoba Credits.

Renters

If you rent your home, you may still qualify to receive up to $700 in savings with the EPTC. The Credit is claimed on the Manitoba Income Tax Form MB479 – Manitoba Credits.

Seniors

If you are 65 of age or older by the end of the year, you may qualify for additional savings from the Manitoba government to help cover your education property taxes:

Seniors School Tax Rebate

Manitoba seniors who live in their own homes may be eligible for the Seniors’School Tax Rebate. Learn more.

Seniors with income under $40,000

Senior households with income under $40,000 may be eligible for an additional EPTC of up to $400. The Credit is claimed on the Manitoba Income Tax Form MB479 – Manitoba Credits. Learn more.

For more information, please contact:

Manitoba Tax Assistance Office

Phone: 204-948-2115 (Toll-free 1-800-782-0771)

email: TAO@gov.mb.ca

Farmland School Tax Rebate

The Farmland School Tax Rebate (FSTR) was implemented in 2004 to support the rural economy by providing Manitoba farmland owners with school tax relief. The rebate percentage has increased from 33% in 2004 to 80% in 2016. Landowners are required to submit an annual application to Manitoba Agricultural Services Corporation (MASC). Once you are registered with MASC and receive a rebate, a pre-printed application form for the following year will be mailed to you when they become available. First time applicants can find application forms and additional information on this website in the fall of 2018.

How it works

If you are a Manitoba resident who owns farmland in Manitoba and you paid your 2017 property taxes, you may be eligible for the rebate. The rebate applies only to the school taxes assessed on your farmland and does not apply to residences or buildings.

How to apply

If you received a rebate for 2016,a 2017 application form was mailed to you. You can also download an application form from masc.mb.ca or pick one up from your local Manitoba Agricultural Services Corporation (MASC) office, Manitoba Agriculture office or municipal office.

For more information:

Website: masc.mb.ca/fstr

Email: fstr@masc.mb.ca

Phone: 204.726.7068